99

2013

Annual Report

35

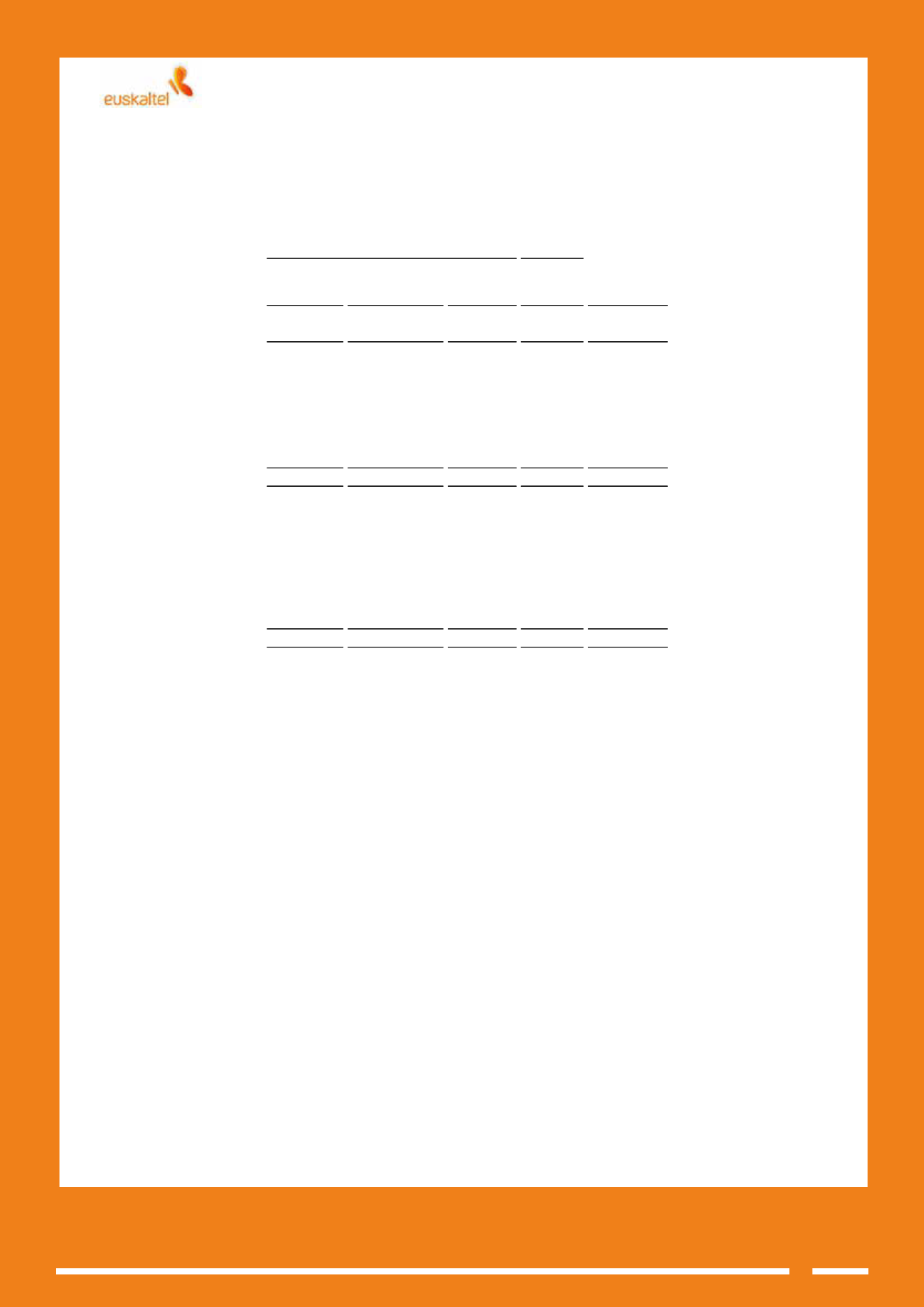

16.2.

Deferred tax

Details of deferred taxes, which are all deferred tax assets, and movement are as follows:

Liabilities

Temporary

differences

Tax credits for loss

carryforwards

Tax

deductions

Temporary

differences

Total deferred

taxes

Balance at 01.01.12

3,567

41,160

141,572

-

186,299

Application of accrued income tax

expense

(1,763)

(9,226)

(3,954)

-

(14,943)

Unlimited deductions from the prior

year

-

-

695

-

695

Unlimited deductions for the year

-

-

963

-

963

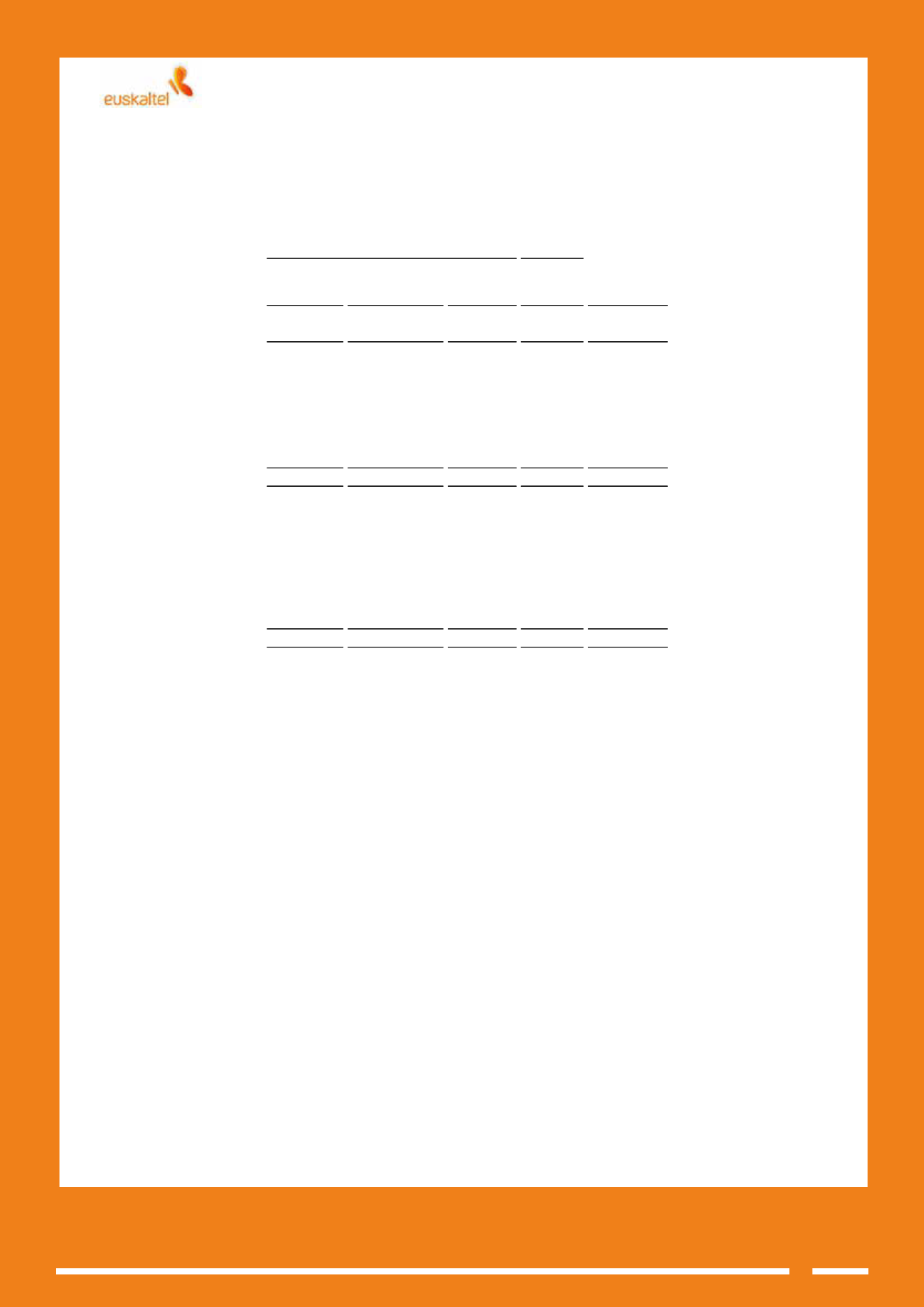

Balance at 31.12.12

1,804

31,934

139,276

-

173,014

Application of accrued income tax

expense

5

(11,288)

(2,374)

-

(13,657)

Hedging financialassets

250

-

-

(26)

224

Unlimited deductions for the year

-

-

691

-

691

Other adjustments

18

548

(205)

-

361

Balance at 31.12.13

2,077

21,194

137,388

(26)

160,633

Assets