89

2013

Annual Report

25

NOTE 12

. Cash and Cash Equivalents

At 31 December 2013 and 2012 the balances reflect the Company's cash and financial instruments convertible

to cash with a maturity of less than three months.

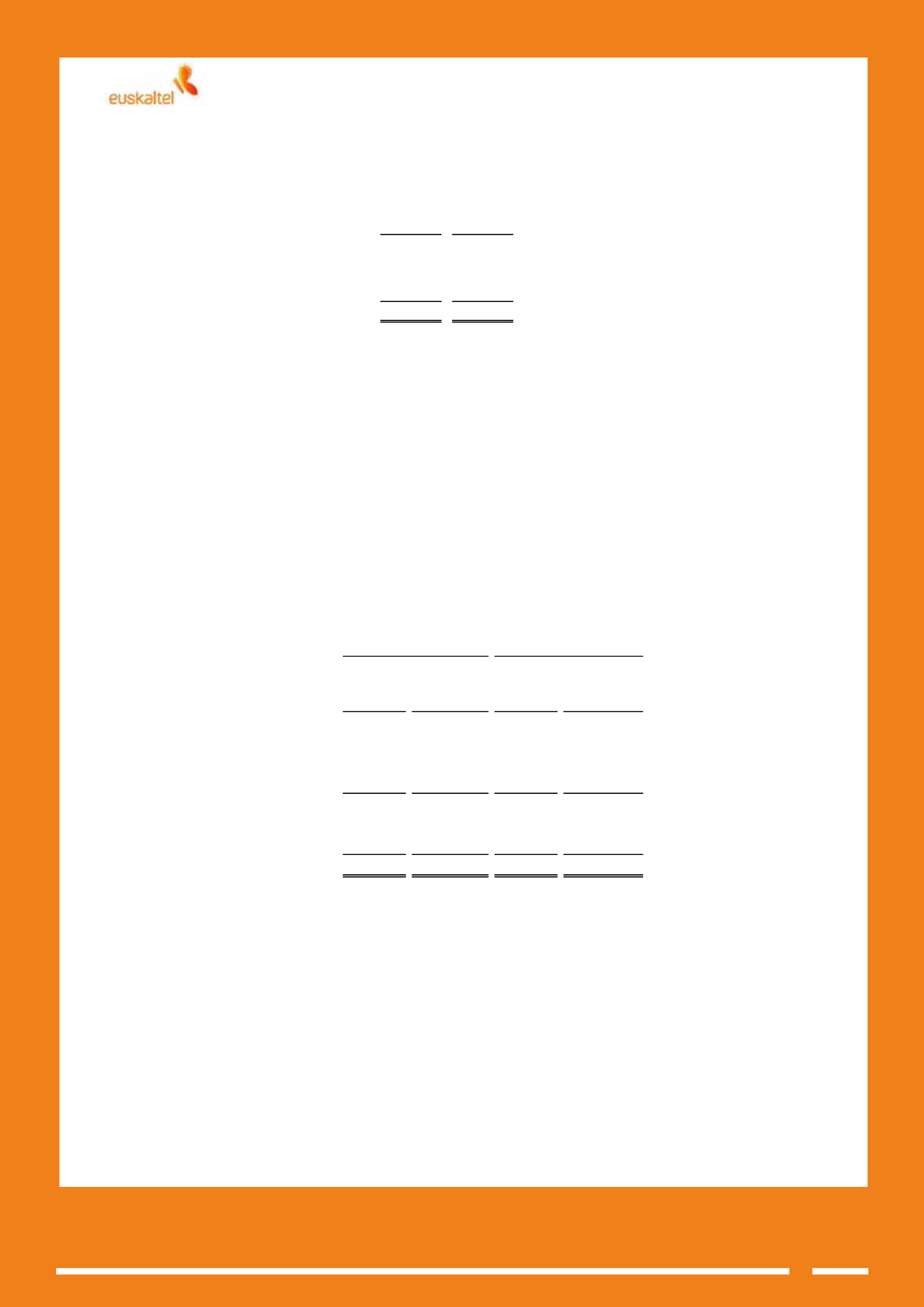

NOTE 13

.- Equity

13.1.

Capital

At 31 December 2013 and 31 December 2012 the subscribed capital of the Company is represented by

6,326,890 registered shares of Euros 60 par value each, with the same rights and obligations, subscribed and

fully paid. Article 9 of the Company's articles of association stipulates the regulation for the transfer of its

shares.

At 31 December 2013 and 2012 the companies which hold an interest in the share capital of the Company and

their percentage ownership, are as follows:

Since 1 January 2012, as a result of the spin-off of the financial businesses of Bilbao Bizkaia Kutxa, Aurrezki

Kutxa eta Bahitetxea (BBK), Caja de Ahorros y Monte de Piedad de Gipuzkoa y San Sebastián – Gipuzkoa eta

Donostiako Aurrezki Kutxa (Kutxa) and Caja de Ahorros de Vitoria y Álava – Araba eta Gasteizko Aurrezki Kutxa

(Vital) to Kutxabank, S.A., the latter (Kutxabank) has assumed all obligations and all the rights and shares

comprising the equity of BBK, Kutxa and Vital.

2013

2012

Cash

1,292

227

Cash equivalents

4,997

-

Total

6,289

227

Number of

shares

Percentage

ownership

Number of

shares

Percentage

ownership

Kutxabank, S.A.

2,710,065

42.83% 1,910,038

30.19%

CK Corporación Kutxa–Kutxa Korporazioa, S.L.

-

-

800,027

12.64%

Araba Gertu, S.A.

447,053

7.07% 447,053

7.07%

Grupo Kutxabank

3,157,118

49.90% 3,157,118

49.90%

International Cable, B.V.

3,043,234

48.10% 3,043,234

48.10%

Iberdrola, S.A.

126,538

2.00% 126,538

2.00%

Total

6,326,890

100.00% 6,326,890

100.00%

31.12.2013

31.12.2012