87

2013

Annual Report

23

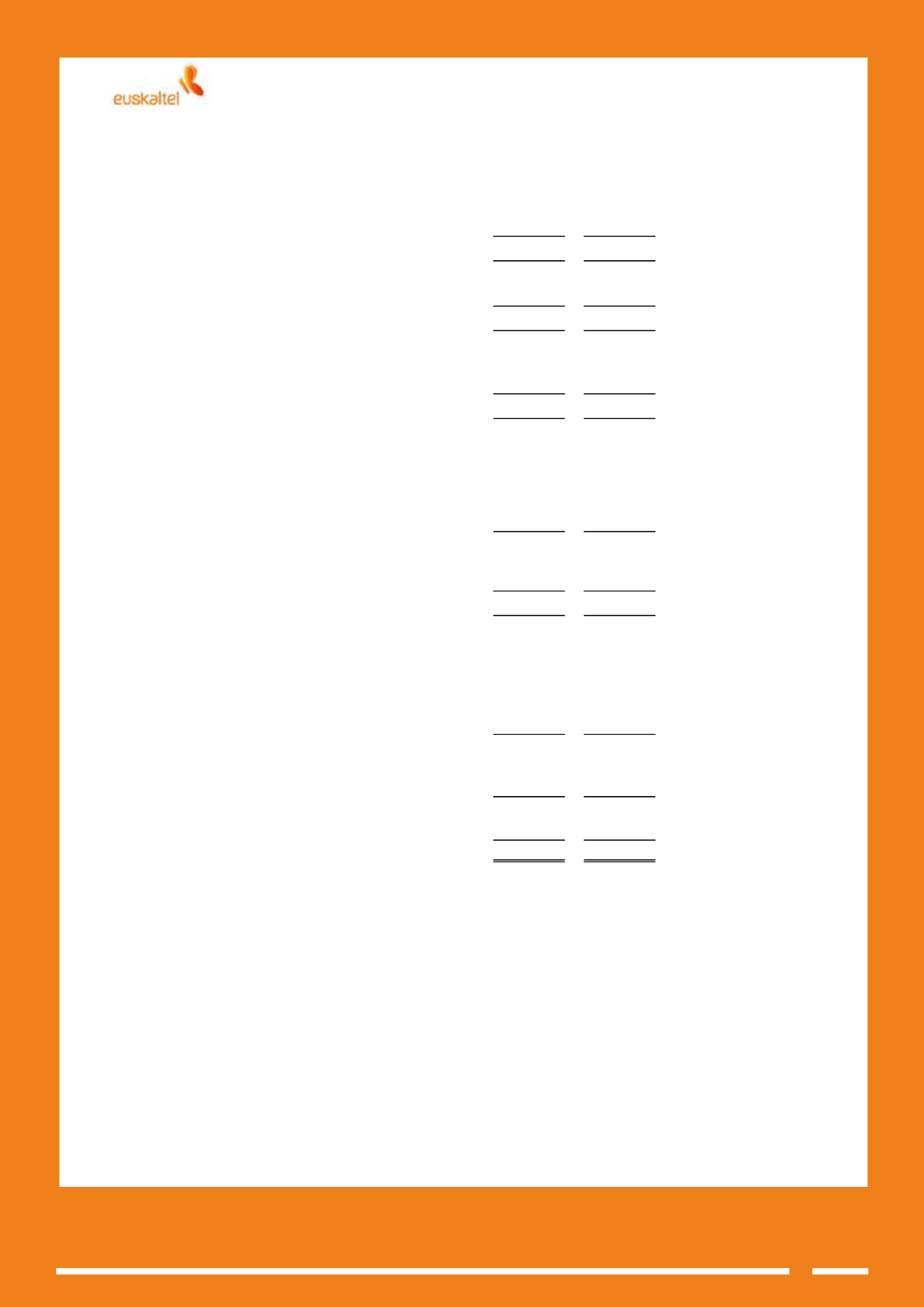

NOTE 9

.- Loans and Receivables

Non-current receivables earn variable interest pegged to Euribor.

The Company makes provision for impairment of trade and other receivables adding, to the total amount of

balances that have exceeded a minimum period determined in accordance with pertinent legislation applicable

to the sector, a percentage of past-due balances that do not exceed the aforementioned minimum period,

estimated using historical data on the recovery of Company balances, as it considers that the application of

this criterion represents a reasonable estimate of the impairment of the aforementioned financial assets.

2013

2012

Non-current loans and receivables

3,085

278

Non-current investments in Group companies

and associates

8

11

Loans to companies

8

11

Loans to associates

475

478

Provisions for impairment

(467)

(467)

Non-current investments

2,296

267

Loans to third parties

1,941

-

Loans to third parties

1,954

480

Provisions for impairment

(13)

(480)

Derivatives

92

-

Other financial assets (security deposits)

263

267

Trade and other receivables

781

-

Trade receivables (exceeding operating cycle)

781

-

Current loans and receivables

39,586

40,776

Trade and other receivables

39,395

40,724

Trade receivables

55,710

62,338

Provisions for impairment

(16,383)

(21,679)

Personnel

61

61

Public entities, other

7

4

Current investments in

Group companies and associates

171

3

Loans to companies

91

3

Other financial assets

80

-

Current investments

20

49

Loans to third parties

-

39

Other financial assets (Deposits and guarantees)

20

10

Total

42,671

41,054