84

2013

Annual Report

20

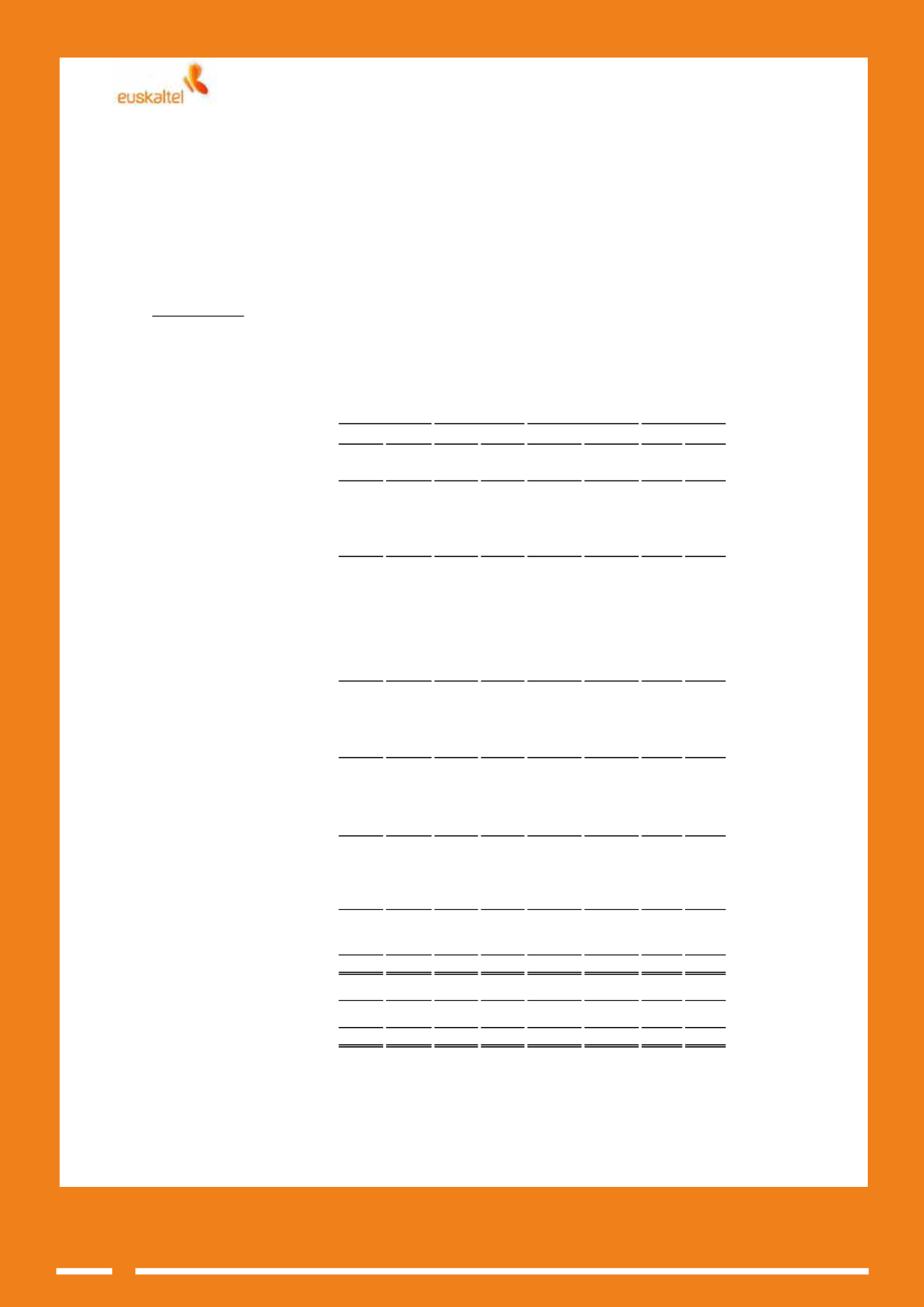

NOTE 7

.- Analysis of Financial Instruments

7.1.

Analysis by category

At 31 December 2013 and 2012 the carrying amount of each of the categories of financial instruments

established in the recognition and measurement standard for financial instruments is as follows:

a)

Financial assets

2013 2012 2013 2012

2013

2012 2013 2012

Non-current investments in

Group companies and associates

8

11

-

-

24

24

32

35

Equity instruments

-

-

-

-

24

24

24

24

Loans to Group companies

and associates

8

11

-

-

-

-

8

11

Non-current investments

2,296 267 855 855

-

- 3,151 1,122

Equity instruments

-

-

855

855

-

-

855 855

Loans to third parties

1,941

-

-

-

-

- 1,941

-

Hedging derivatives

92

-

-

-

-

-

92

-

Other financial assets

(Security deposits)

263

267

-

-

-

-

263 267

Trade and other

receivables, non-current

781

-

-

-

-

-

781

-

Trade receivables

(exceeding operating cycle)

781

-

-

-

-

-

781

-

Trade and

other receivables

39,388 40,720

-

-

-

- 39,388 40,720

Trade receivables

39,327 40,659

-

-

-

- 39,327 40,659

Personnel

61

61

-

-

-

-

61

61

Current investments in Group

companies and associates

171

3

-

-

-

-

171

3

Loans to Group companies

and associates

91

3

-

-

-

-

91

3

Other financial assets

80

-

-

-

-

-

80

-

Current investments

20

49

-

-

-

-

20

49

Loans to third parties

-

39

-

-

-

-

-

39

Other financial assets

20

10

-

-

-

-

20

10

Total financial assets

42,664 41,050 855 855

24

24 43,543 41,929

Trade and other receivables

7

4

-

-

-

-

7

4

Public entities, other

7

4

-

-

-

-

7

4

Total balances on balance sheet

42,671 41,054 855 855

24

24 43,550 41,933

Investments in

equity instruments

of Group

companies, jointly

controlled entities

and associates

Loans and

receivables

Available-for-

sale assets

Total financial

assets