88

2013

Annual Report

24

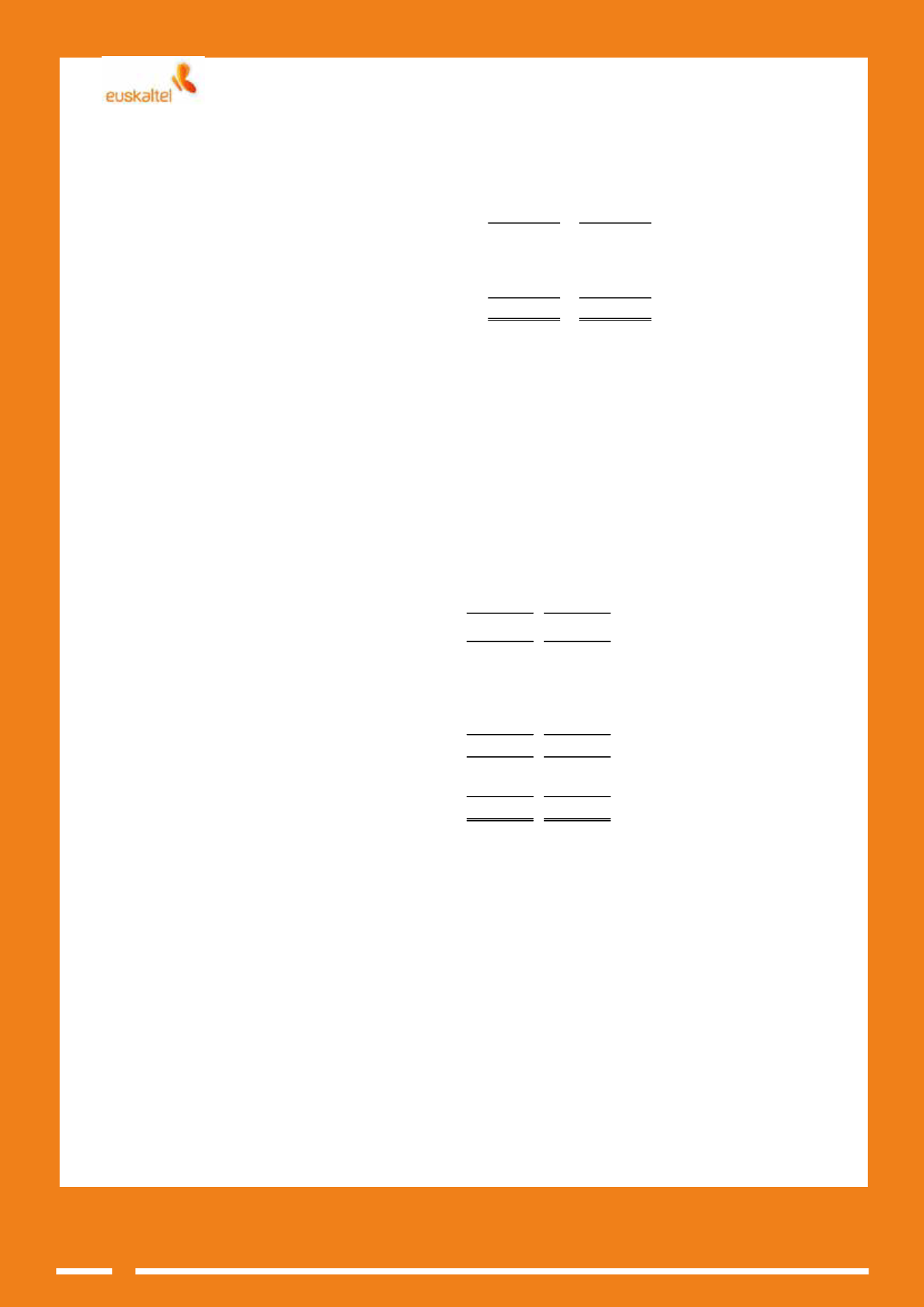

Movement in the provision for impairment of trade and other payables is as follows:

Impairment of trade receivables is recognised and reversed under losses, impairment and changes in trade

provisions under other operating expenses in the income statement, and totals Euros 2 million. In 2012 losses

totalled Euros 3 million and a provision of Euros 6.8 million was reversed.

NOTE 10

.- Available-for-sale Financial Assets

At 31 December 2013 and 2012 available-for-sale financial assets amount to Euros 855 thousand and include

non-controlling interests in different companies measured at cost less impairment.

NOTE 11

.- Inventories

The Company has contracted sufficient insurance coverage for the risk of damage to inventories.

2013

2012

Opening balance

21,679

28,440

Provision for impairment of trade receivables

1,848

3,057

Bad debts written off

(7,144)

(9,818)

Closing balance

16,383

21,679

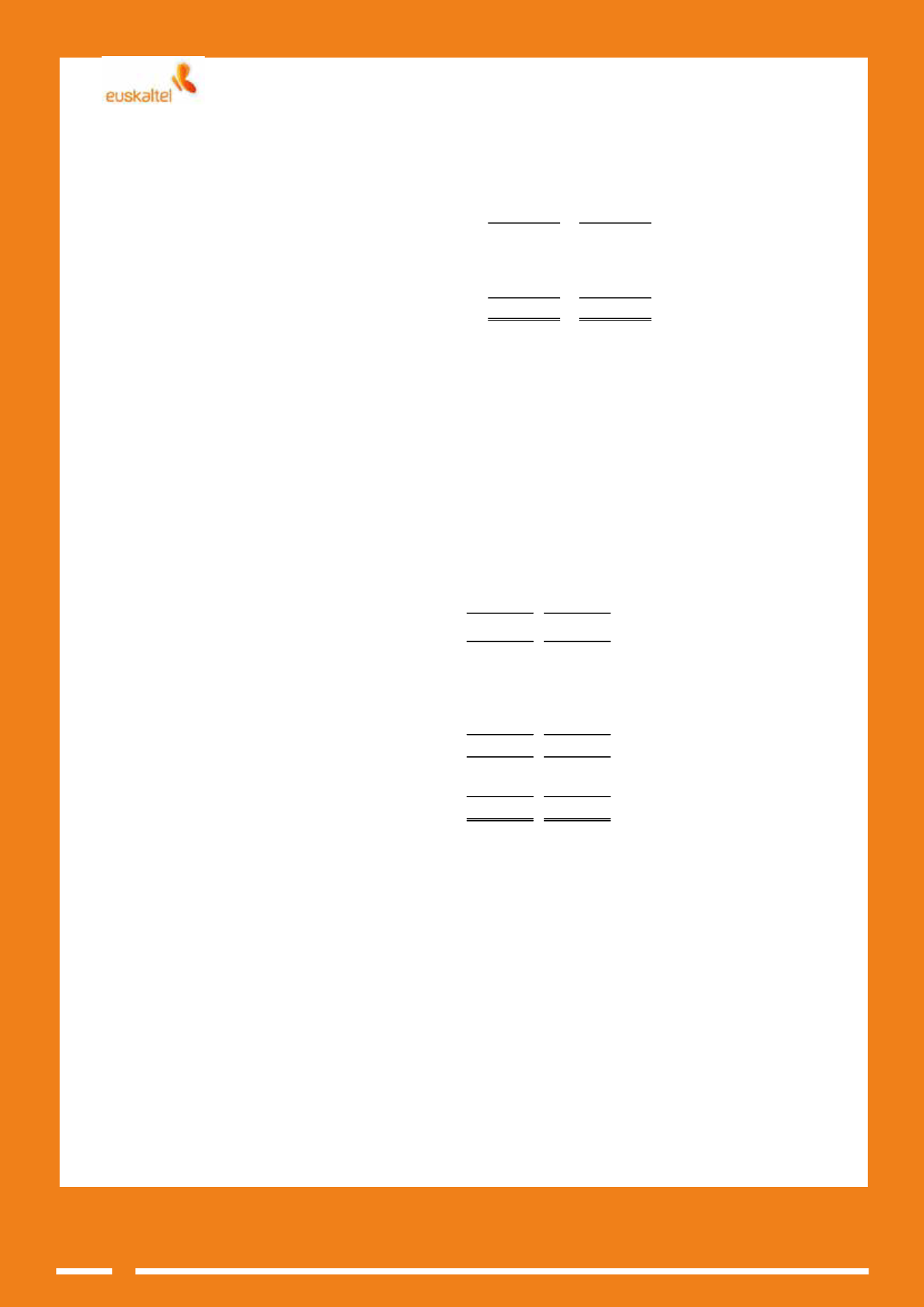

2013

2012

Customer terminals and equipment

2,314

3,264

Mobile phones

985

676

Digital television decoders

1,329

2,588

Contract materials

1,754

2,593

Other inventories

241

489

Total gross amount

4,309

6,346

Impairment losses on inventories

(2,107)

(2,520)

Total

2,202

3,826