98

2013

Annual Report

34

In 2013 the Company has applied limited income tax deductions of Euros 1.7 million (Euros 3.9 million in 2012).

At 31 December 2013 the Company has unused limited and unlimited income tax deductions for investments

and other items as follows:

Euros 137.4 million of the aforementioned deductions have been capitalised at 31 December 2013 (Euros 139.3

million in 2012). Capitalisation is based on the Company's annual recoverability analyses, considering estimated

future tax profits and the accounting (not tax) recovery limit of 10 years.

Under local legislation, tax credits in respect of loss carryforwards and deductions generated prior to 2013 do

not expire.

The Company has open to inspection all main applicable taxes for the years still open to inspection.

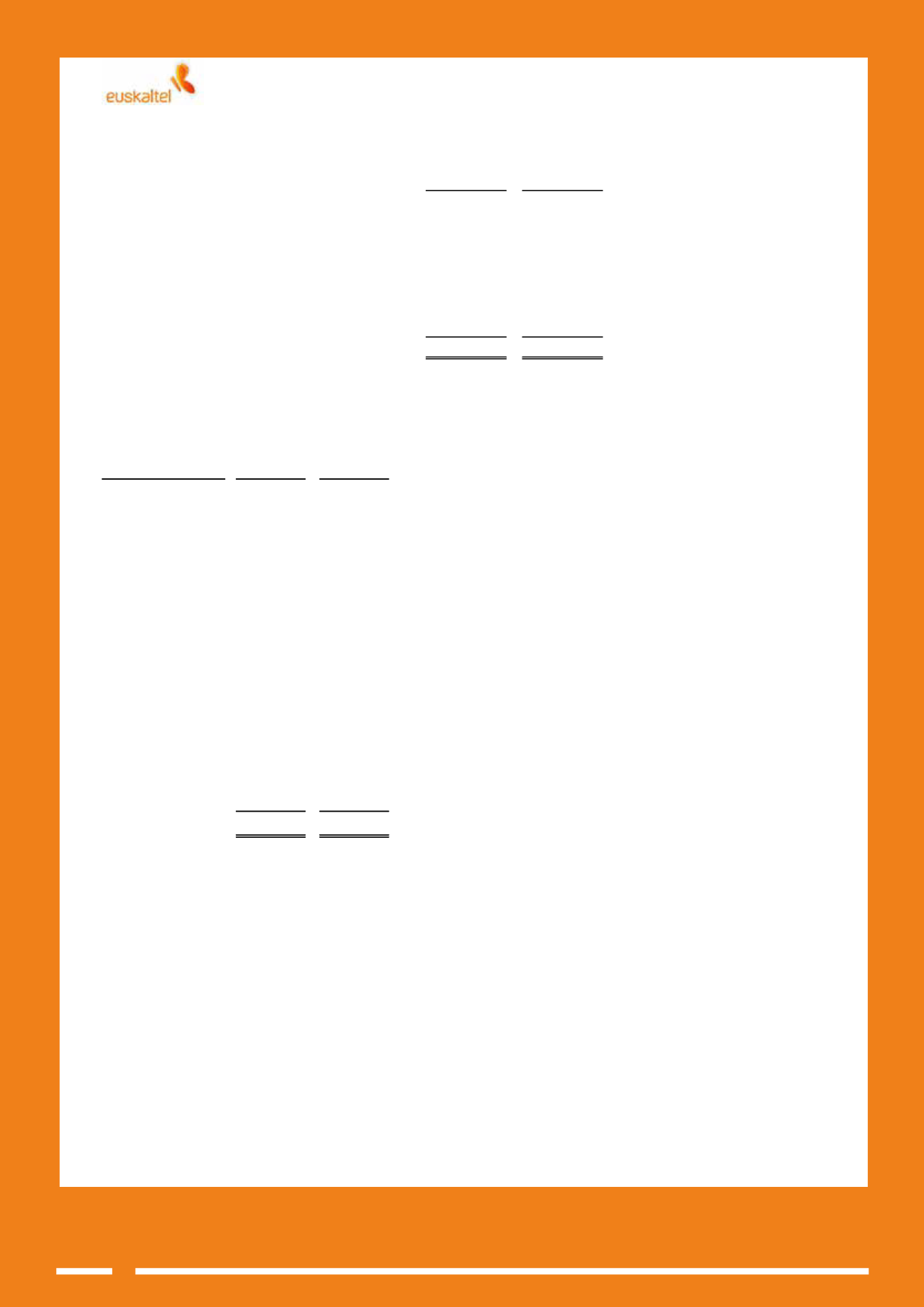

2013

2012

Accrued income tax expense

16,122

14,943

Unlimited deductions for the year

(691)

(963)

Unlimited deductions from prior years

(381)

(695)

Other adjustments

22

(1)

Amount of deductions taken to profit for the year

(7,798)

(8,043)

Total income tax

7,274

5,241

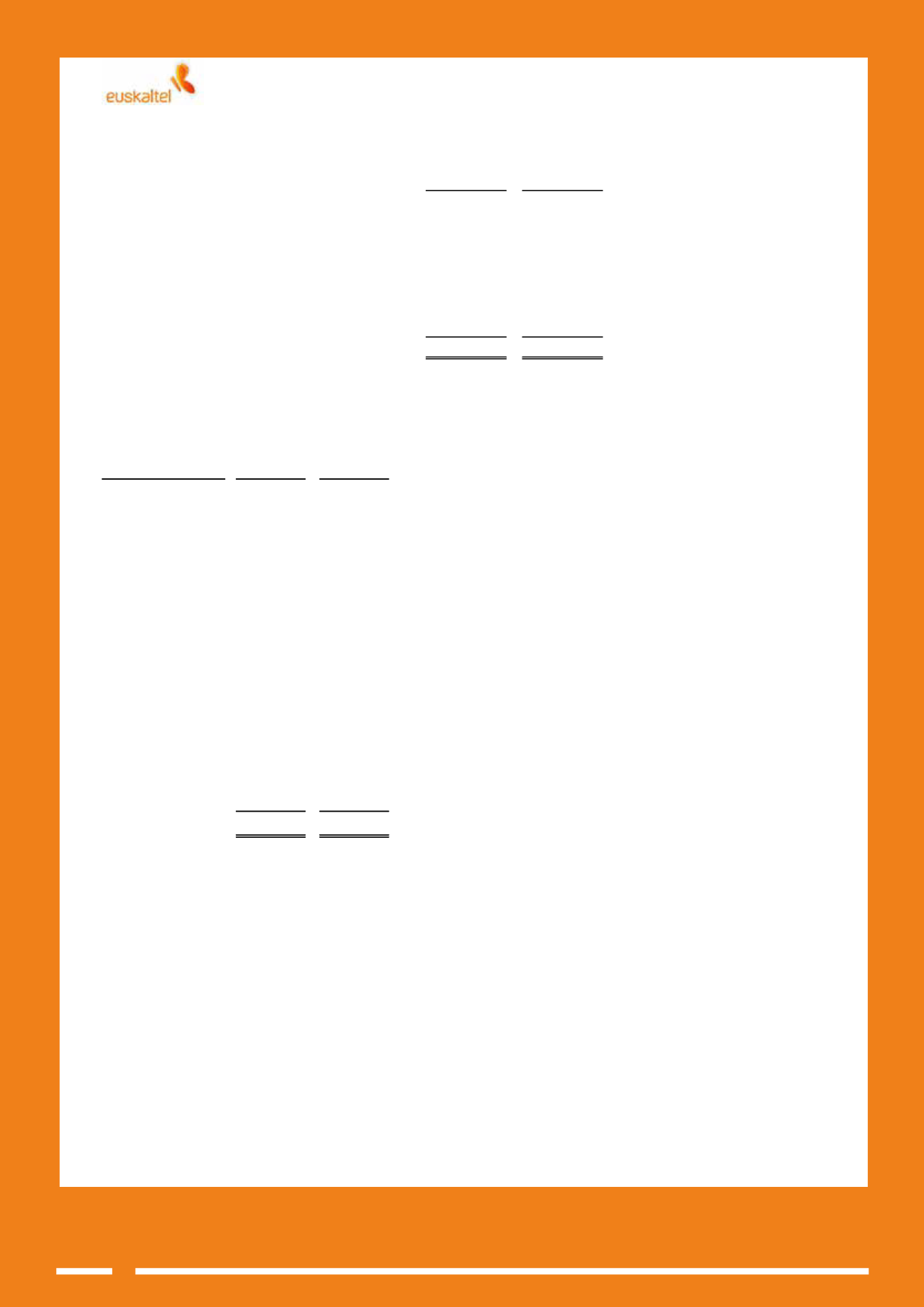

Year of origin

2013

2012

1999

2,184

4,072

2000

17,265

17,265

2001

23,002

23,002

2002

10,399

10,399

2003

17,310

17,310

2004

16,388

16,388

2005

12,512

12,512

2006

9,927

9,927

2007

12,760

12,760

2008

13,920

13,920

2009

773

773

2010

949

949

2011

1,063

1,063

2012

832

-

Total

139,284 140,340